tax return rejected ssn already used stimulus

If someone uses your SSN to fraudulently file a tax return and claim a refund your tax return could get rejected because your SSN was already used to file a return. The first thing to do in this situation is to make sure that your social security number and those of your spouse and dependents are correct.

Tas Tax Tip Tax Resources For Individuals Filing A Federal Income Tax Return For The First Time Tas

Sometimes the state tax return will be accepted for efiling even when the federal return has been rejected.

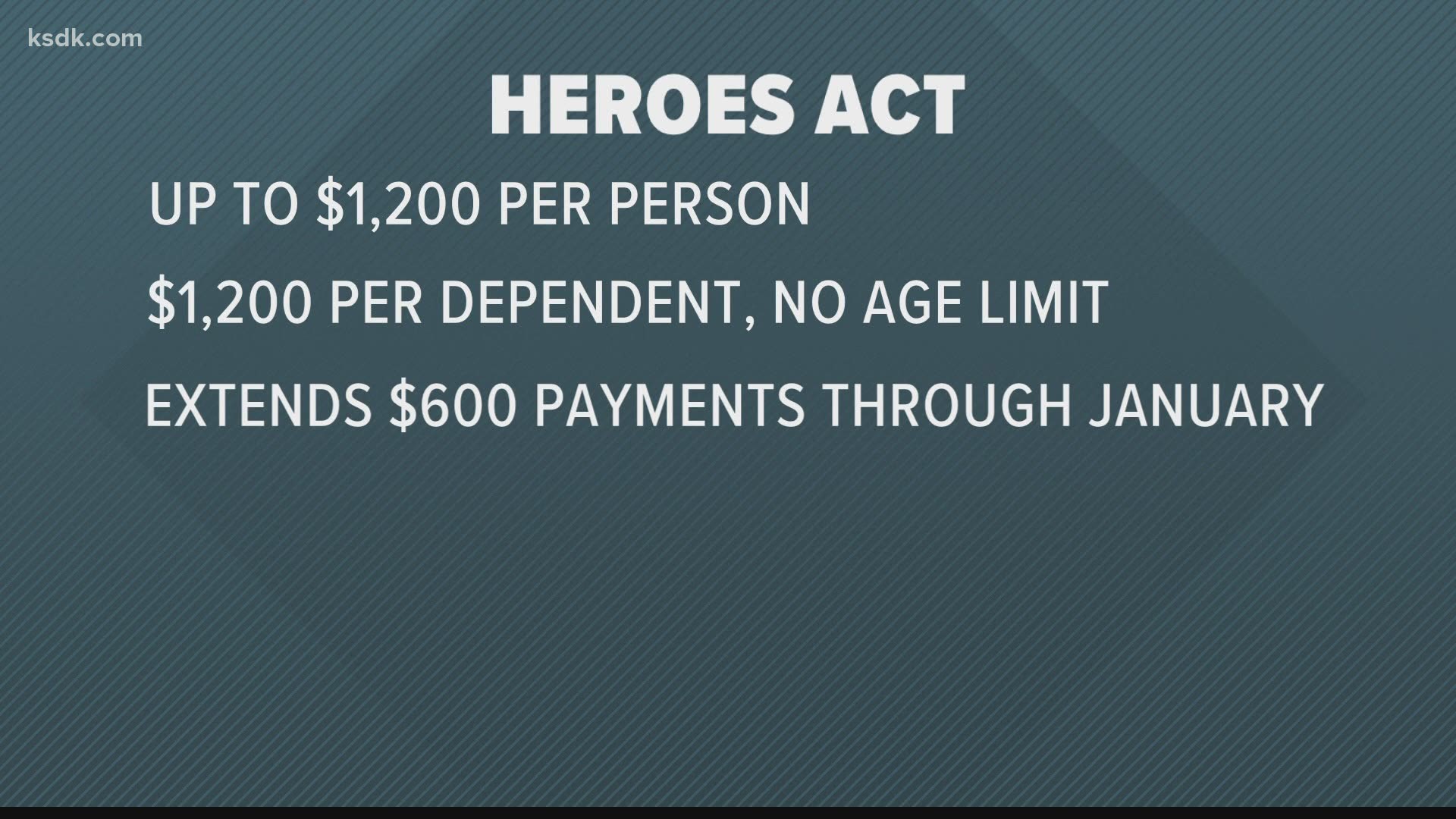

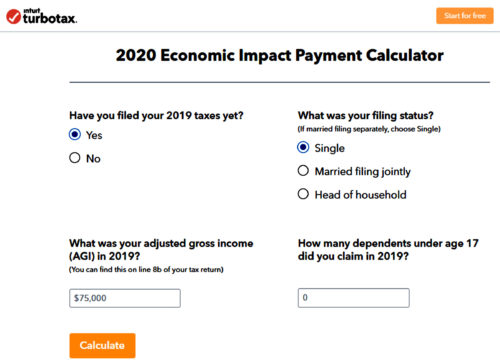

. You will not be able to e-file this year. If your return was rejected due to your dependents SSN being used on another return the first thing to do is to verify that you entered the SSN correctly in the return. In the first round of stimulus payments individuals earning less than 75000 in adjusted gross income qualified for the full 1200 payment and married couples filing a joint.

What To Do If Your Federal. SSN has been used on a previously accepted return. Due to an amendment to the 1992 Taxpayers Bill of Rights residents are eligible this year for a tax rebate of 750 or 1500 for a couple who filed taxes jointly.

Rejected due to SSN already used. I know I have not filed previously this year. Whether the cause of this rejection is the result of a typo on another.

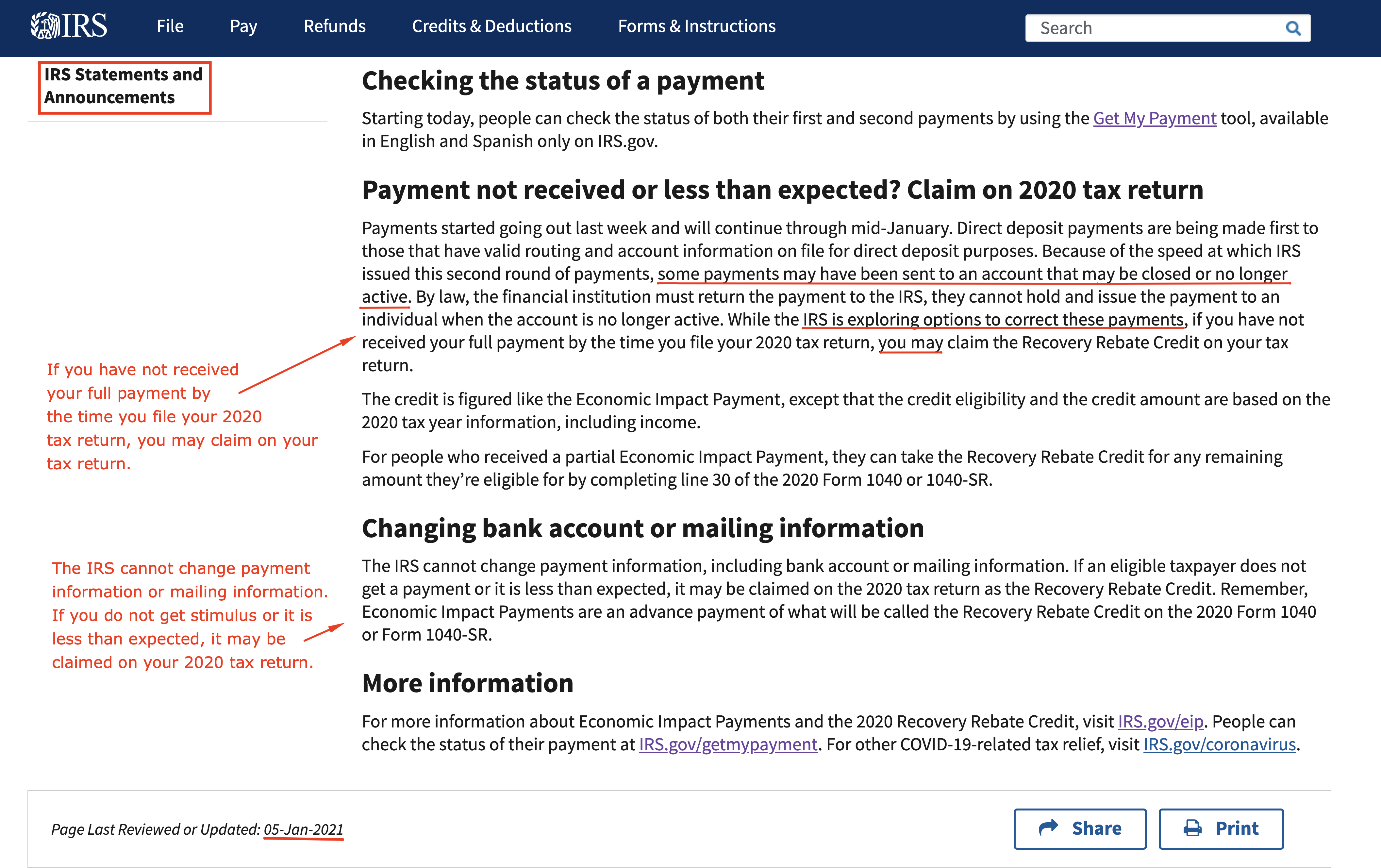

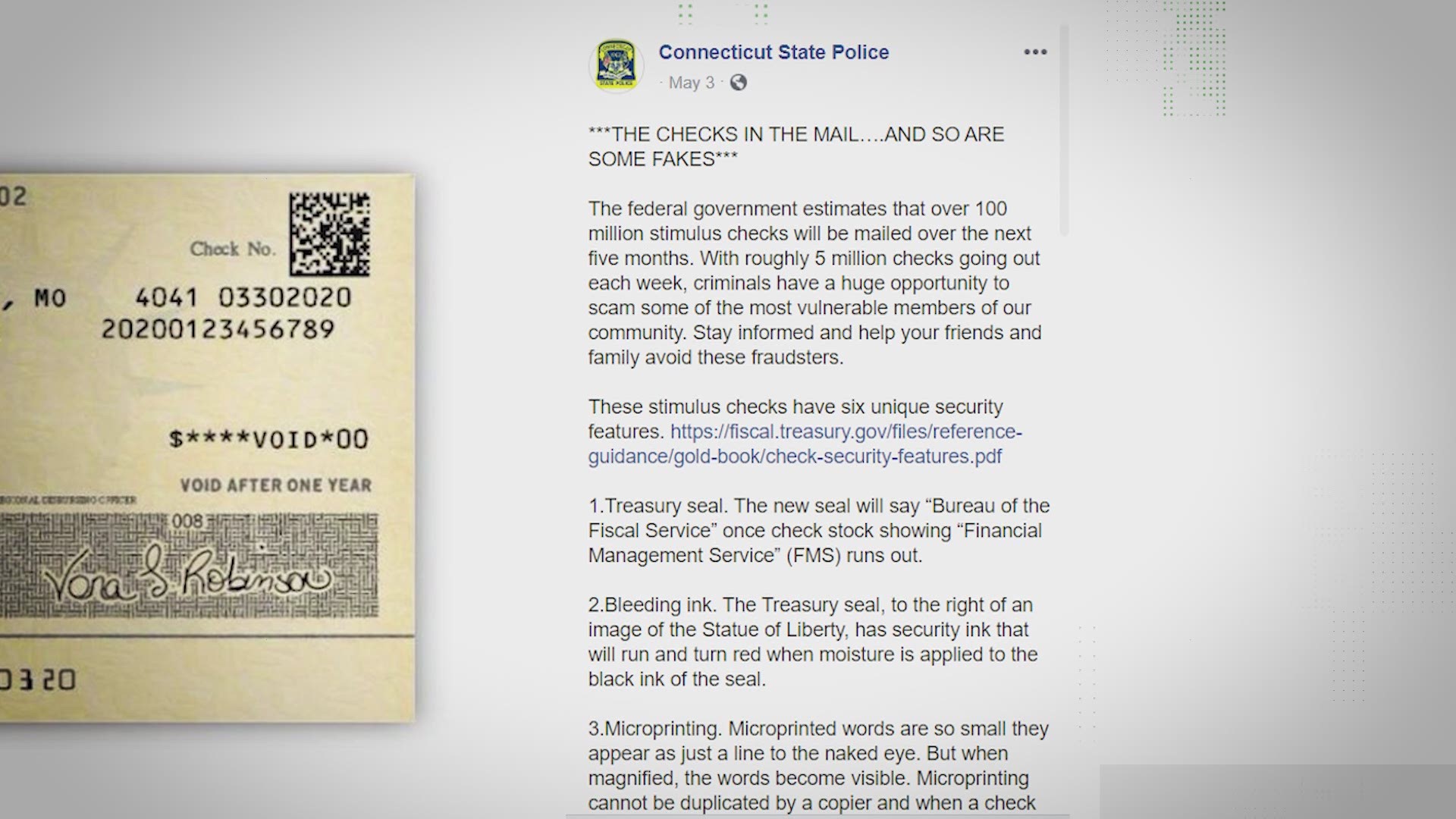

According to the IRS those who filed 2018 or 2019 tax returns and provided direct deposit information would automatically receive the payments in their bank accounts. This morning I received an email stating that my tax return was rejected due to my SSN already being used. If someone has stolen your Social Security Number and filed a fraudulent tax return to receive your refund your tax filing will be rejected if you try to e-file.

Your return will have to. A few weeks ago I entered my info for a non-filer so I could change my bank. My 1040 was rejected with code R0000-502-001.

If you mail in your. To timely file a paper return after an electronic return was rejected you must file the return by the later of the due date of the return or 10 calendar days after the date the IRS. If you did not use the non-filer site then another possibility is that someone else filed a tax return and claimed you as a dependent.

If you already have a Social Security Number SSN or Individual Taxpayer Identification Number ITIN the number must be included on Form 8843 regardless of your age and even if you are. If it turns out there is tax-related identity theft on your federal return it. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year.

Tax Refund Status Is Still Being Processed

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdk Com

10 Steps To Take If Your Tax Return Is Rejected Gobankingrates

Ssn Already Used By Someone Else On A Tax Return Crossborder Planner

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdk Com

Scammers Steal Identity To File Fake Tax Returns Get Refund

Tax Return Refund Deposit Options Mail Or Direct Deposit

Common Irs Error Reject Codes And Suggested Solutions Taxslayer Pro S Blog For Professional Tax Preparers

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc7 San Francisco

Someone Used My Social Security Number To File Taxes What Do I Do

Solved Why Was My Stimulus Package Registration Via Direct Deposit Rejected And Now So Have To Mail It In

The 13 Latest Tax Refund Scams To Beware Of 2022 Update Aura

Register For Your Stimulus Payment Free Easy Online Cares Act

3 17 79 Accounting Refund Transactions Internal Revenue Service

One Reason Your E File Tax Return Was Rejected The Washington Post

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdk Com